That is a known fact that blogging is not just for individuals. Corporate blogs that utilize their reach to promote their products and businesses started to gain popularity among people, and thus, blog has emerged as one of the low cost and high return – the best marketing tool on the web. Blogging has given a new way for the marketers to interact with possible customers and clients – Promote! If you know how to maximize marketing opportunities through your blog, it can be one of the best marketing tools you will be hiding in your tool box.

Tool for Improving Visibility

A blog will require you to create content and update regularly with information. Quality content is usually linked by other bloggers. If an entrepreneur launches a new business idea and if it is good it will be linked by most bloggers and will be the talk of town. This will definitely help you to gain better placement in search engines and increases your visibility.

Tool for Building Customer Loyalty

The interactive aspects of blogs stimulate exchange and incite Internet users to return regularly to follow the discussion and even participate. Moreover, the important feature of blog is that it allows you to receive instant feedback and reviews on your products or your business. This rapid and instant feedback will help you tweak and respond better to the market you are trying to target. You can get feedbacks within minutes after publishing a post.

Tool for Promoting Events or Ad Campaigns

In 2003, Nike launched the first major campaign using a blog. For 20 days prior to the official launch of a new ad campaign, Nike invited Internet users to share their opinions about the works of 15 young filmmakers exploring the theme of “the art of speed.” This concept is also being applied for album and movie launches, or to encourage discussion following tradeshow. So, advertising is FREE with blog and you can save great advertising and media release cost. Now, that is marketing at its best and your blog helps you do that.

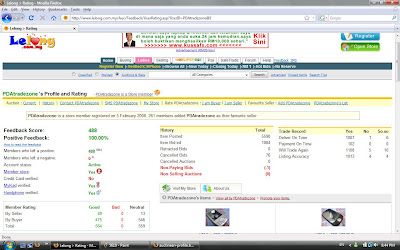

The chart above shows some of the organizations that are at the forefront of the corporate blogging wave. In addition to the big corporate names and the bloggers at companies involved in the blogging space, there are a large number of individual consultants, small business owners, and individuals which fill the “other” category. These are people who are blogging about what is going on at their businesses.

Even though some of the largest technology companies are represented in this graph, it shows that we are still at the relative start of accepted use of blogging as a part of corporate policy - and that there is still a tremendous opportunity for forward-thinking companies and management to have a significant positive impact on their public perception by encouraging an enlightened blogging policy, encouraging openness both within and outside of the organization.

References:

http://marketinghackz.com/the-importance-of-blogs-in-business-and-marketing/

http://www.adviso.ca/en/using-blogs-as-a-marketing-tool.html

Malicious code such as viruses, worms, and Trojan horses can infiltrate personal computers, allowing attackers to compromise the integrity of software packages or even take control of your computer. It's up to you to protect your critical information.

Malicious code such as viruses, worms, and Trojan horses can infiltrate personal computers, allowing attackers to compromise the integrity of software packages or even take control of your computer. It's up to you to protect your critical information. Hackers' virus-like worms are constantly “knocking on doors” looking for available targets. You can help protect your computer by using a firewall. Firewall software on computers protects them from the hazards of the Internet by monitoring the types of activity or attempted activity between the computer and a network. Computers guarded by a firewall can refuse attempted connections that aren't initiated by you or that are suspicious.

Hackers' virus-like worms are constantly “knocking on doors” looking for available targets. You can help protect your computer by using a firewall. Firewall software on computers protects them from the hazards of the Internet by monitoring the types of activity or attempted activity between the computer and a network. Computers guarded by a firewall can refuse attempted connections that aren't initiated by you or that are suspicious. Even computers that are protected by a firewall and safeguarded against viruses can be targeted by spyware. Spyware is software that appears to offer some tangible benefit, but actually monitors your behavior, typically to deliver targeted popup advertising. This illegal access is often used to intercept the user IDs and passwords to your online accounts. So, install anti-spyware software which will help combat and remove spyware from your computer.

Even computers that are protected by a firewall and safeguarded against viruses can be targeted by spyware. Spyware is software that appears to offer some tangible benefit, but actually monitors your behavior, typically to deliver targeted popup advertising. This illegal access is often used to intercept the user IDs and passwords to your online accounts. So, install anti-spyware software which will help combat and remove spyware from your computer. Your best line of defense on the Internet is your password. No amount of technology can protect you if your password becomes compromised or is easy to guess. Here are a few tips for keeping this personal information safe.

Your best line of defense on the Internet is your password. No amount of technology can protect you if your password becomes compromised or is easy to guess. Here are a few tips for keeping this personal information safe.